Some Words on Travel Expenses: Specific Options

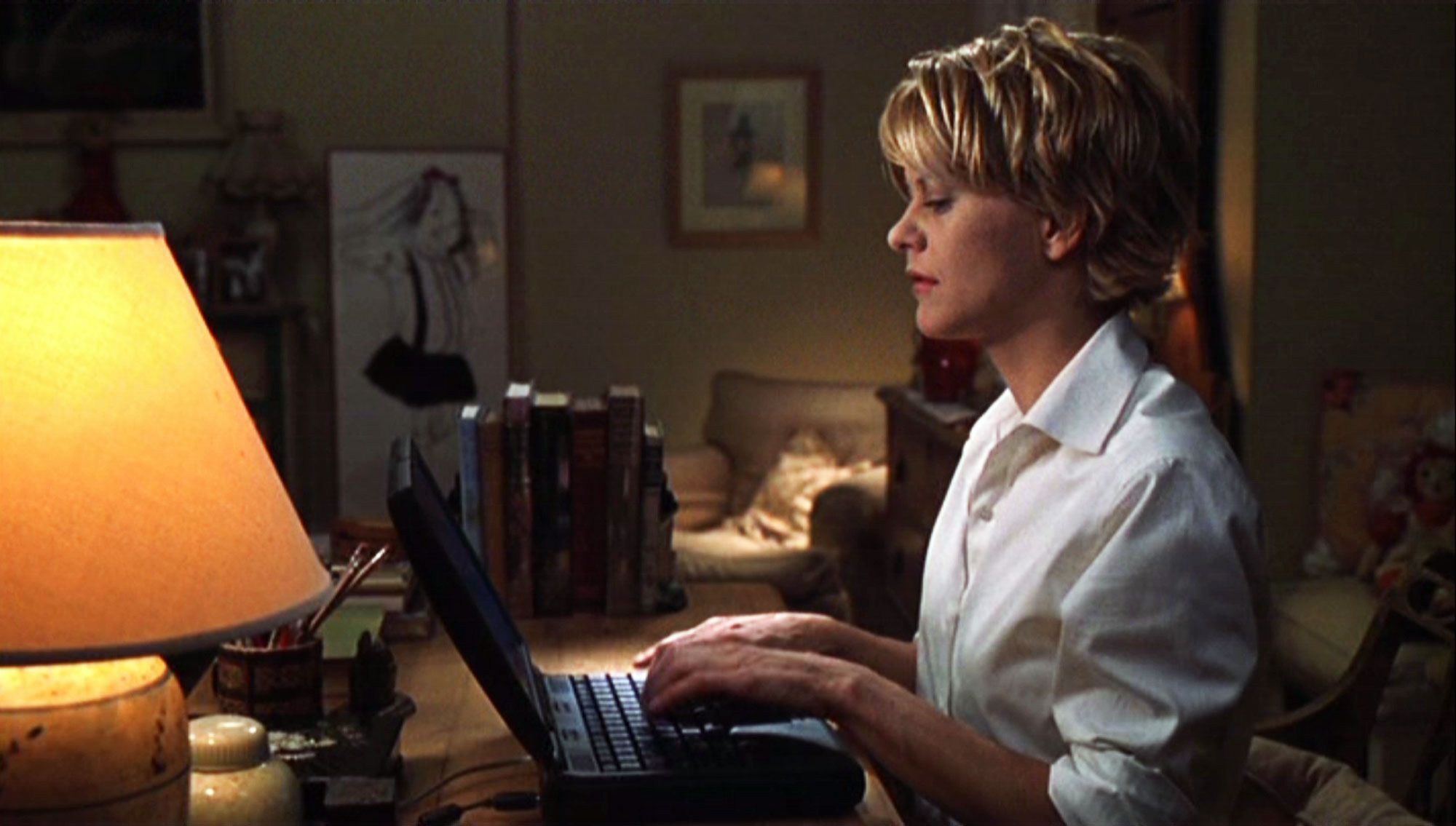

Everyone who travels for business effectively juggles two jobs: the one that demands the trip, and the one of recording and reporting the trip’s details and expenses to superiors. As a business traveller, you are aware that trying to keep track of everything throughout your trips may be difficult and distracting. Given the status of the economy, it is likely that your superiors are already pressuring you to reduce needless business travel. It would be advantageous if your firm used a mobile booking application that also controlled receipts, but sadly, this is not the case for many organizations.

Make a Choice

In light of this, please know that we are here to assist you. You’ll find some of our finest advice for managing expenditures (in both the actual and metaphorical meanings) below, such as how to keep trip information organized to make filling out that the expense report a snap and how to save a few dollars here and there to stay under budget as well as keep the bosses happy.

If an employee incurs unapproved costs, the procedure must begin over from the “collect the records” step, and it is the worker’s responsibility to either withdraw the claim or produce supporting documentation.

The report was delivered to the corresponding accounts payable employee. The coordinator of accounts payable is currently responsible for publishing the expenditure report.

After the report is published, there may be a strategy in place to fund its production expenses. Whoever is responsible for payroll must ensure that the employee gets paid on time. The travel expense reports are important here.

Check the Receipts

In this instance, the receipts’ validity has been confirmed. Before being included to the appropriate accounting or taxation file, every receipt submitted by an employee must undergo a thorough authenticity check.

You may still claim a tax deduction based on the information on the receipts, even if you have lost or discarded them. The IRS recognizes digital receipts as legitimate evidence of a transaction for tax purposes.

The report may contain accounting category data or similar information. Accounting personnel must input the right codes for each expenditure report line item.

It is essential to highlight that these categories are ambiguous and often change based on the particulars of the expenditures at hand. Transportation, accommodation, food, and amusement expenses are linked with offshore personnel.

Find the Reports

The report on expenditures is now available for examination. After expenses have been submitted as journal entries in the ERP or accounting system, validated, and posted, they are added to the general ledger. Due to the fact that checks are not issued by accounts payable until appropriate expenses have been recorded, the employee’s payment is assured. This guarantees that the worker will be compensated for their time. This improvement is advantageous to the accounting and auditing processes.

In the event of a disagreement over the company’s finances or an audit by the Internal Revenue Service, the employee may use these reports as evidence of all business expenses spent during the applicable time period (IRS).

Conclusion

Now, the reimbursement payment is authorized. The refund payment has been accepted and will be issued in accordance with the company’s spending policy. Upon receipt of the reimbursement authorization, accounting staff will have finished their job in the expenditure management process. This will occur prior to any work being performed.